41+ turbotax not deducting mortgage interest

Mortgages can be considered money loans that are specific to property. Ad Search Over Hundreds Of Tax Deductions w TurboTax To Maximize Your Tax Refund.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

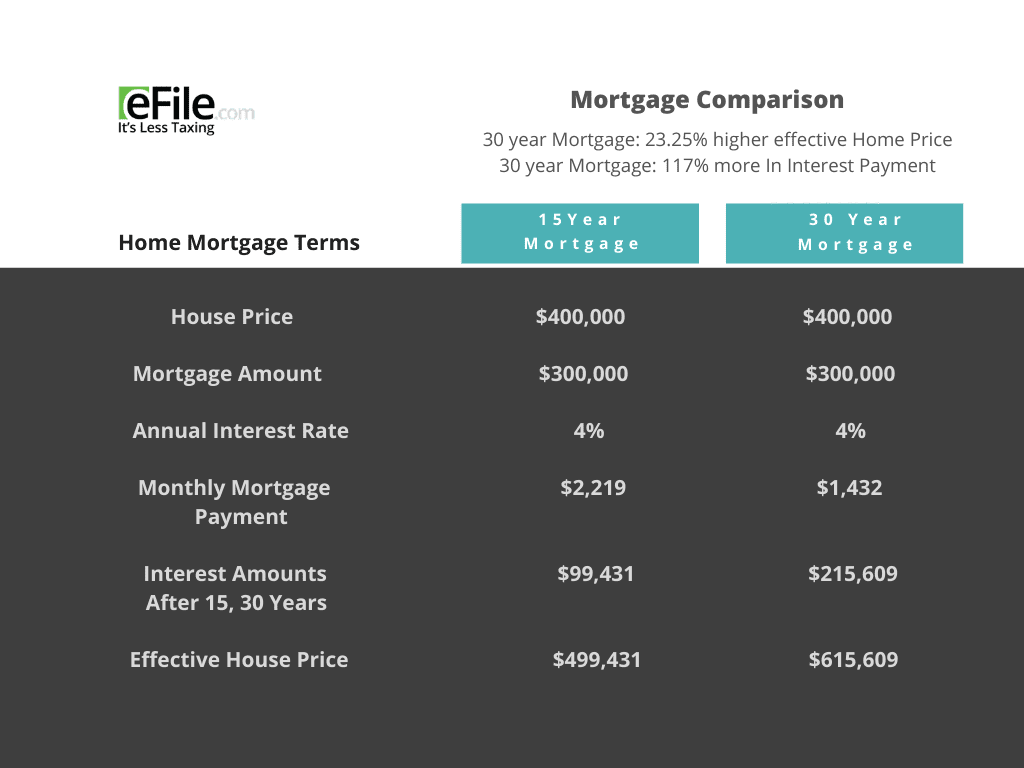

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

. Web TurboTax Canada. On part A of that worksheet it says 1 - Home mortgage interest and points reported on Form. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

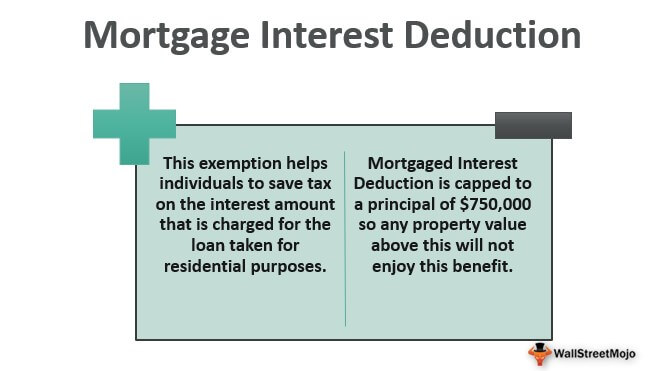

Web Up to 25 cash back Because the total amount of both loans does not exceed 750000 all of the interest paid on the loans is deductible. Web You cant deduct the principal the borrowed money youre paying back. Web To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have.

If the home equity loan was for 300000 the. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. If they are incurred for the purpose of earning income by renting.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web Due to the caps on mortgage interest deductions based on principal amount this could result in you unknowingly paying thousands of dollars more in taxes. Homeowners who are married but filing.

More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web On that form there is a Mortgage Interest Limited Smart Worksheet.

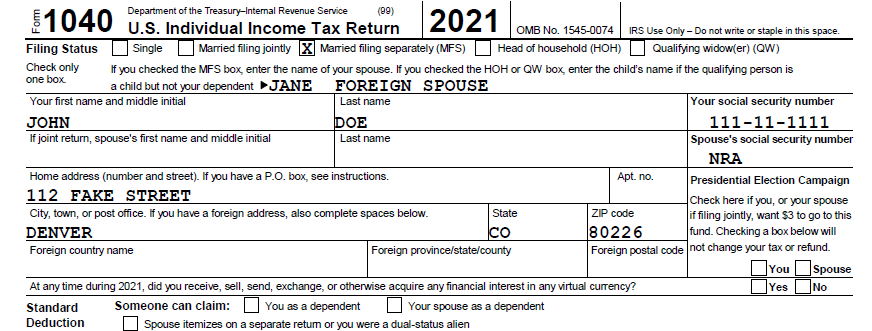

Do You Need An Itin For Your Non Resident Alien Foreign Spouse If You Re Married Filing Separately O G Tax And Accounting

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Deducting Home Mortgage Interest In Unusual Circumstances Gilbert J Munoz C P A

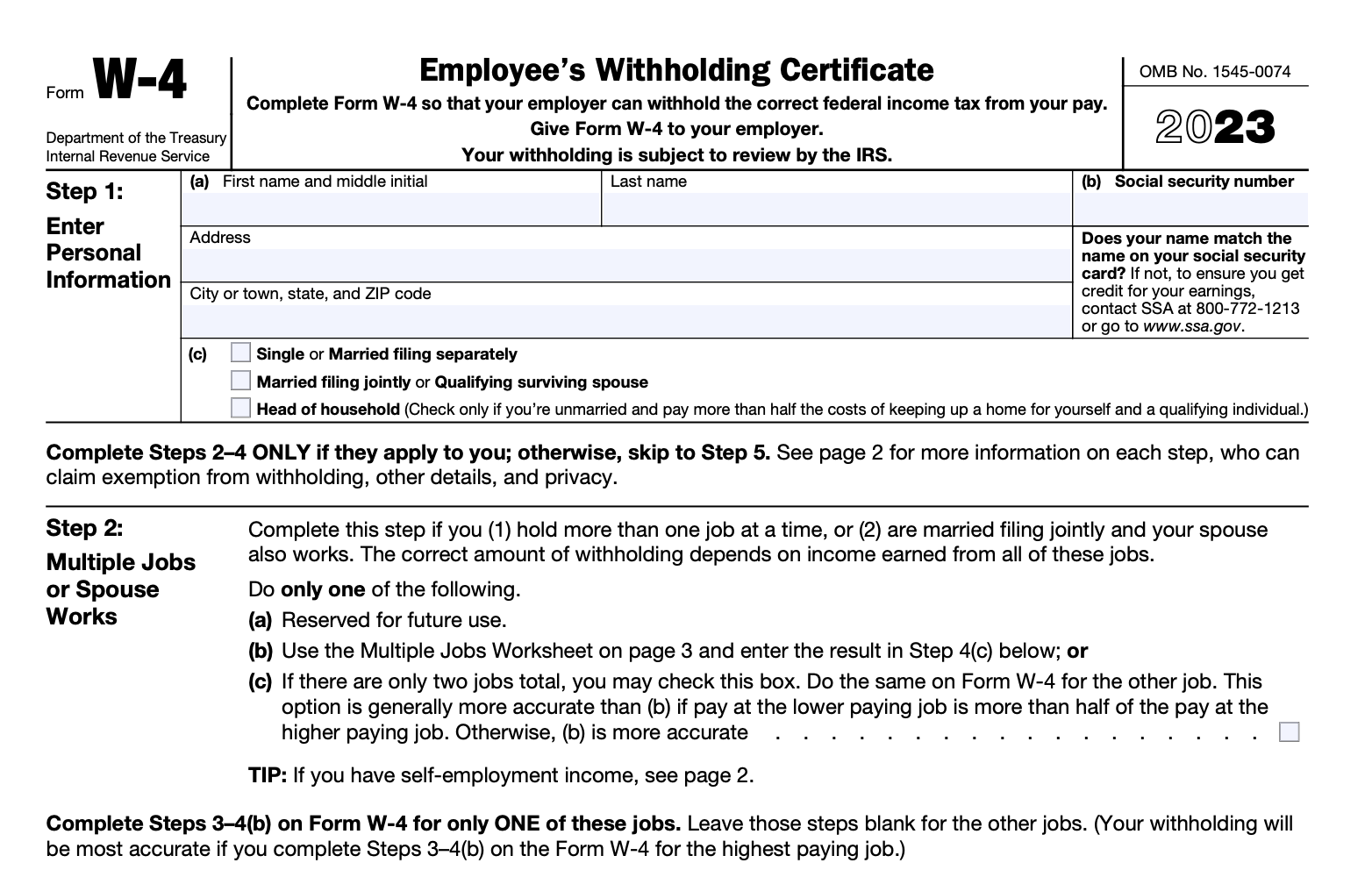

What Is The W 4 Form Here S Your Simple Guide Smartasset

Home Mortgage Loan Interest Payments Points Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

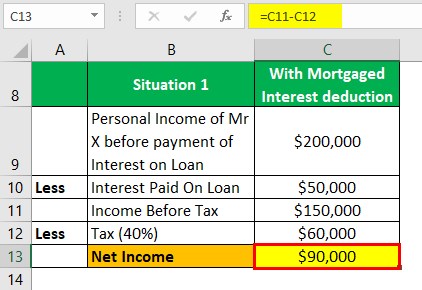

Mortgage Interest Deduction How It Calculate Tax Savings

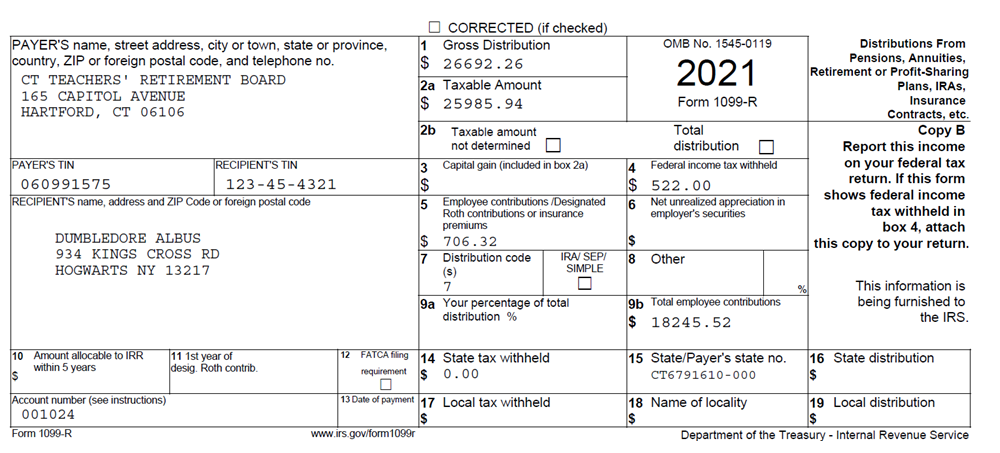

How To Read Your 1099r

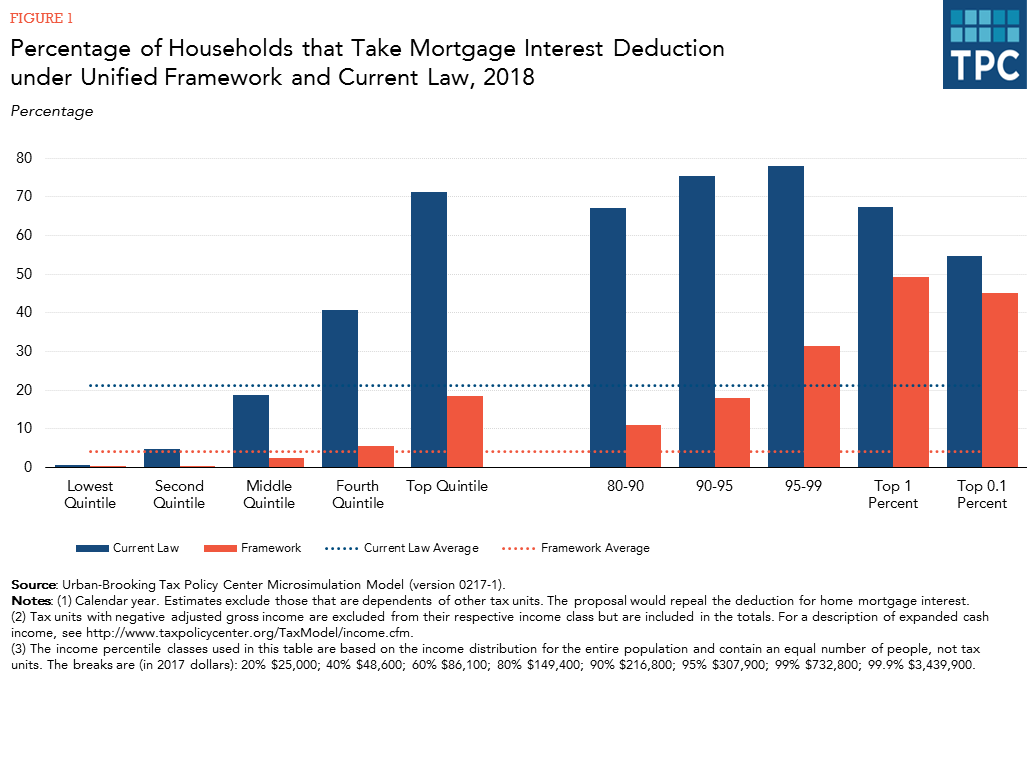

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Gutting The Mortgage Interest Deduction Tax Policy Center

A Guide To The 1098 Form And Your Taxes Turbotax Tax Tips Videos

Irs Announces 2023 Tax Filing Season Start Date Deadlines Money

Solved Turbotax Premier Not Deducting Mortgage Interest On Refinanced Mortgage

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Mortgage Interest Deduction How It Calculate Tax Savings

Turbotax Offers Refund Advance To Taxpayers The Turbotax Blog