26+ soft credit pull mortgage

This is because other creditors realize. Mortgage lenders usually rank applicants using an industry-standard credit scoring model known as the FICO score.

Soft Credit Check Mortgage Isoftpull

Low flat lender fee of 995.

. Ad Apply For Business Line Of Credit. No SNN Needed to Check Rates. See if you qualify.

Our professional and friendly mortgage specialists are available to help every step of the wayeven after. Web Then you can get as many quotes as needed without worrying about damaging your credit. Web What Is A Soft Credit Check.

Lock Your Mortgage Rate Today. Web Within a 45-day window multiple credit checks from mortgage lenders are recorded on your credit report as a single inquiry. When you authorize a creditor lender or financial institution to pull your credit report to check your credit history and score as is the case with a mortgage.

VA Loan Expertise and Personal Service. Web Hard vs. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

A credit score of at least 620 is recommended to. Get your free credit score. Ad Dedicated to helping retirees maintain their financial well-being.

In the months leading up to your home purchase you could take the opportunity to work on improving your credit. Web The first step to get pre-qualified for a mortgage is to speak with a lender who offers great rates and customer service. Web 5 steps to get preapproved for a home loan.

By comparison your payment history is worth 35 of your FICO. Web In this scenario 100000 of the refinanced mortgage would go toward paying off your existing mortgage along with any other costs due at closing and the remaining 40000. Apply Now With Quicken Loans.

Ad Put Your Credit Plan in Place with Tools You Wont Find Anywhere Else like CreditCompass. A soft credit check also called a soft credit pull or a soft credit inquiry occurs when you a company or an authorized individual. From soft pull credit reports to prequalify your customers to compliance services we have it.

Contact a Loan Specialist. Web Since the lender pulls your credit when you submit an application this is considered a hard credit inquiry and can affect your credit report and credit score. Ad Explore Home Loan Options with the Army National Guard Today.

Get Lowest Rates Grow Your Business Today. Web Let Soft Pull Solutions help your mortgage company with credit reporting services. Web A soft credit pull or soft inquiry does not affect your credit score.

Were Americas Largest Mortgage Lender. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. The first one is when you check your own score.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web How to Get Your Credit Ready for a Mortgage. Get Your Quote Today.

Web Lenders typically look for a credit score of at least 620 though it depends on other factors such as your debt-to-income ratio cash for a down payment and more. Web With FICO scoring models for example credit inquiries influence 10 of your credit score. Web Heres why.

Refresh Your Credit Daily with TransUnion. Web Soft inquiries also known as soft pulls or soft credit checks typically occur when a person or company checks your credit as part of a background check. Your full credit report is not released in a soft inquiry though some information is disclosed.

Web A soft credit inquiry is when lenders look at your credit to gauge whether youre preapproved for credit when you check your own credit or when entities like. Web Chenoa Fund down payment assistance 2nd liens may be used in conjunction with an FHA-insured 1st mortgage financing so long as the first mortgage adheres to applicable. Credit Scores Can Change Daily.

Check Out Army National Guard Home Loan Benefits Today. Lenders on Zillow are licensed and have a history of positive. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Low Fixed Mortgage Refinance Rates Updated Daily. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. These are common when you apply for a.

Its helpful to know where you stand before reaching out to a lender. Web There are two situations that involve a soft credit check for a mortgage. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Differences Between Hard and Soft Inquiries Pulls A Hard Inquiry happens when a financial institution checks your report to make a lending decision. Since that is a soft inquiry it wont. This model assigns a.

Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Ad Compare Mortgage Options Calculate Payments. The Best Lenders All In 1 Place.

How Many Times Will A Mortgage Lender Pull My Credit

Soft Credit Check Mortgage Isoftpull

Soft Credit Check Mortgage Isoftpull

Soft Credit Check Mortgage Isoftpull

How Many Times Can You Pull Credit For A Mortgage

Hard Pull Vs Soft Pull On Credit What You Need To Know

Mortgage Shopping Without Hurting Your Credit Quicken Loans

How Many Times Will A Mortgage Lender Pull My Credit

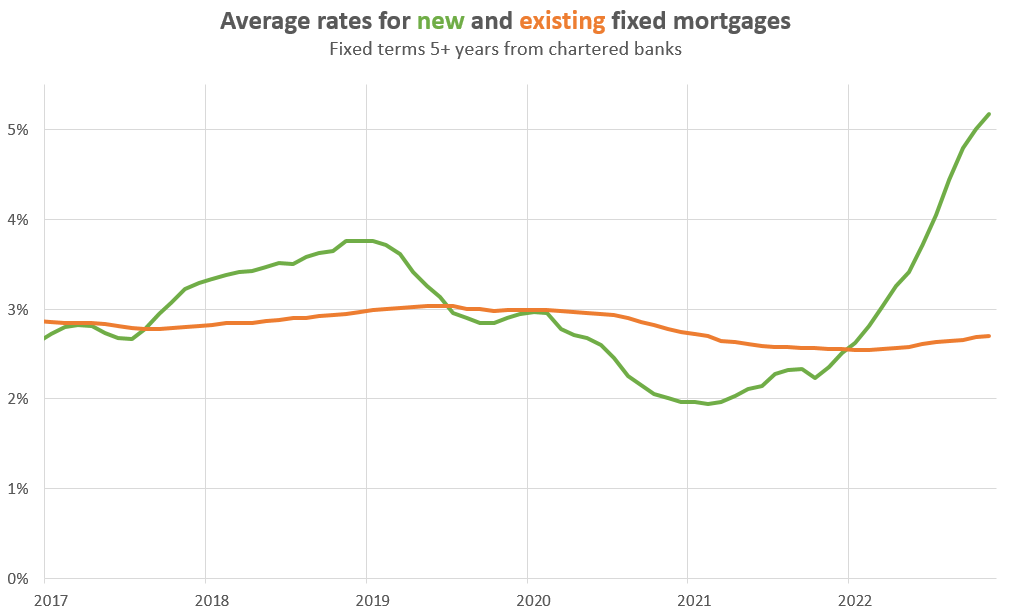

Changing Rates And The Market House Hunt Victoria

Soft Vs Hard Credit Checks What S The Difference

Changing Rates And The Market House Hunt Victoria

How Many Credit Checks Before Closing On A Home Big Valley Mortgage

Hard Vs Soft Inquiries Different Credit Checks Transunion

How Many Times Can You Pull Credit For A Mortgage

26 Sample Credit Reports In Pdf Ms Word

/images/2019/07/03/man-filling-loan-application-to-pull-credit.jpg)

What Is A Hard Credit Pull And Does It Hurt Your Score Financebuzz

28 Free Credit Dispute Letters Templates Word Best Collections